With the pandemic still wreaking havoc across the planet, changes in our personal and professional lives are irredeemably making this year one of the hardest to bear in a long time. Apart from the various impacts on education from COVID-19, sports, the entertainment industry, and the corporate world, we still find changes in consumer behavior across the planet.

With social distancing measures reinforcing many parts of the world in current times, people rely on digital payments to minimize contact.

According to a recent study by Business Wire, digital payment methods and their adoption have evidence to grow tremendously during the COVID-19 outbreak. Nearly 50% of global shoppers used digital payments more than ever before once the pandemic hit the populations across the planet.

Furthermore, more than 60% of digital buyers in Canada use a credit card more often when making payments, while buyers in the UK opt for debit cards; those in Italy choose digital wallets like PayPal.

In light of this information, let’s take a quick look at how COVID-19 will affect digital payments.

1. Preserving Economic Liquidity

When it comes to cashless payments and solutions, payment providers are launching initiatives to preserve economic liquidity. In business terms when we talk about economic liquidity, it can refer to a market feature where any firm or individual can quickly purchase or sell out an asset without making any drastic efforts that could result in changing the asset’s price.

Also falling under the term “market liquidity” where an asset can be quickly sold, this will eventually revitalize the key revenue streams while reducing overdrafts, interest rates, and other fees involved in making transactions.

However, in order to preserve liquidity, there is always the case for exploring other opportunities such as emergency access to cash and other solutions.

2. Consumer Behavior

People around the world are now more open to using contactless payment methods. This is due to the fact that the dangers of catching the virus through contact have made people think about visiting physical stores and making payments with actual cash amounts.

This additional benefit also means less fuel burning and less effort-requirements to shop for groceries and other everyday items.

3. Tokenized Payments

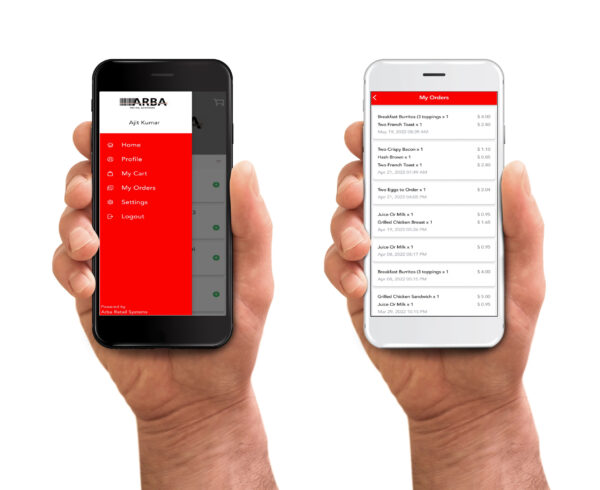

Digital wallets are popular, and their use in the UK shows an increase in users. Furthermore, NFC (near-field communication) phone options are also pushing the global trend of using mobile payments.

Digital wallets are now not only offering easier customer experiences from peer-to-peer and point of sale but are also removing the need for entering PINS and other details.

Most wallets come with two-factor authentication making them remarkably secure while some even feature biometric scanning features. Customers are likely to use these options even after the pandemic since they are able to prove their identity, especially in remote working and living conditions.

4. Controlled Payment Experiences

There is no doubt that with digital payments, both businesses and customers are more in control of their transactions and thus enjoy relative experience organization. Customers can cross-check their history of transactions, see other information about where their money goes in accordance with their resources, and thus plan their budgets accordingly with ease.

The same goes for businesses where they can keep a track record of customer behavior and preferences based on their last shopping spree. Furthermore, COVID-19 has mandated that customers cut down on their traditional purchasing journeys while vulnerable people should avoid them altogether. Online and digital payments are hence an ideal solution in this case scenario.

5. Viable Use of Blockchain Technology

Blockchain technology serves as the cornerstone to support the authenticity and credibility of various cryptocurrency transactions. Now the time has come where it can be further used to support digital payment networks to provide further support to networks that can be built around such notions entirely.

One brilliant use case of blockchain technology making new waves is China which is accelerating the launch of its Central Bank Digital Currency as we speak. Students looking for a dependable coursework writing service also commonly use digital payment methods in their everyday lives.

Conclusion

It doesn’t come as a huge surprise that COVID-19 boosts the use of digital payments in current times as more people are asked to implement social distancing measures and isolation at home. With the pandemic still raging on across the planet, one can surely believe in a future where currency will indeed be paperless, and all transactions will need options through digital means.

If you’re interested in a high-quality Kiosk POS, you can get more information from ARBA Retail POS Systems. Their award-winning inventory management software helps businesses to centralize information in multiple locations while also providing customers with quick and accurate service. Visit them at https://arbapro.com.